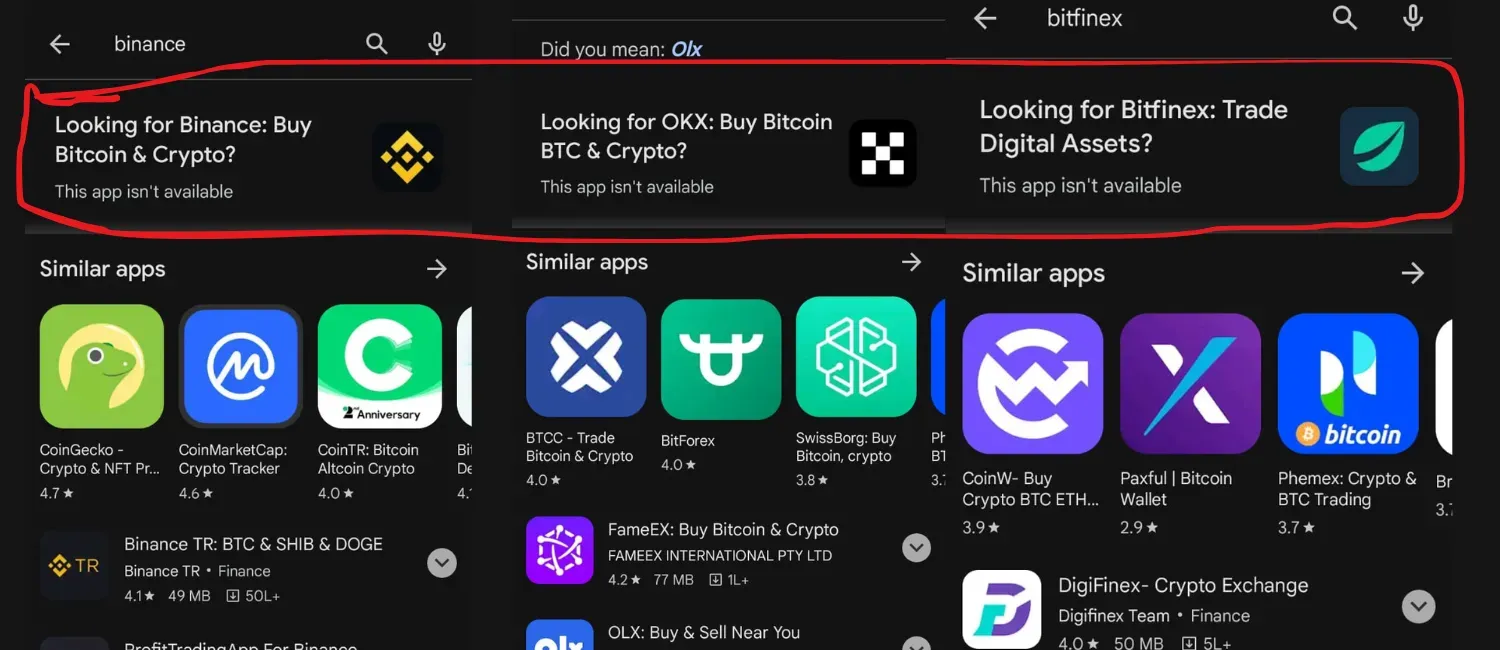

The removal of the apps follows a series of actions taken by the Indian government to crack down on global cryptocurrency platforms operating in the country without proper registration or without the necessary permits and approvals.

Earlier last week, the FIU recommended blocking access to the websites of Binance and 8 other exchanges. By Thursday evening, several Indian internet service providers had already restricted access to these sites.

Here is the list of the services whose websites and Apps were banned in India -

| Services | Website Status | App Status |

|---|---|---|

| Binance | Not Accessible/Banned | Removed |

| Kucoin | Not Accessible/Banned | Removed |

| Huobi | Not Accessible/Banned | Removed |

| Kraken | Not Accessible/Banned | Kraken Pro version available |

| Gate.io | Not Accessible/Banned | Removed |

| Bittrex | Not Accessible/Banned | Removed |

| Bitstamp | Not Accessible/Banned | Available |

| MEXC Global | Not Accessible/Banned | Removed |

| Bitfinex | Not Accessible/Banned | Removed |

| OKX | Not Accessible/Banned | Removed |

The purge of crypto apps from the Play Store delivers another blow to India's struggling cryptocurrency industry. While the apps can technically still function for those who already downloaded them, new users will no longer be able to access them. In addition, key features like withdrawals and UPI transfers are expected to stop working through the apps soon.

This clampdown stems from concerns expressed by the FIU that major global exchanges like Binance could be used for money laundering and tax evasion.

According to an unnamed senior government official, the FIU provided specific inputs indicating these platforms were being used for illegal activities. The FIU sent notices to Binance offices in multiple jurisdictions, as well as to Kucoin, Huobi, OKX, Gate.io, Bittrex, Bitstamp, MEXC Global and Bitfinex.

Domestic vs Global Exchanges

The recent actions underscore differences in how Indian authorities regulate domestic cryptocurrency platforms versus global ones. Leading Indian exchanges like CoinDCX, CoinSwitch Kuber, and WazirX adhere to strict know-your-customer (KYC) rules and have collaborated closely with regulators.

In contrast, global exchanges have far laxer KYC requirements when operating in India. According to industry research, this regulatory arbitrage has led to massive tax leakage, with up to $4 billion worth of crypto assets still parked on offshore platforms. The different rules have also enabled a surge in money laundering via major global exchanges.

By blocking access to global exchanges, authorities hope to drive more trading volume back to fully compliant domestic platforms.

Leading Indian exchange CoinDCX says it has already seen a huge uptick in new registrations as investors transfer holdings back from global apps. To incentivize the shift, CoinDCX is providing up to $1 million in rewards to users making the transition.

Concerns Over Decentralization

However, the crackdown raises concerns that traders may increasingly turn to truly decentralized exchanges that are censorship-resistant. Because these platforms rely on smart contracts rather than a centralized authority, regulators have limited ability to restrict access to them.

Some analysts argue the only long-term solution is for offshore exchanges to voluntarily register with Indian authorities and adhere to know-your-customer norms. This would allow them to operate legally while giving regulators greater oversight of activity. However, major global exchanges have shown little interest in doing this so far.